Quarter Ends Well Despite Trade War, Inverted Yield Curve & Political Crisis

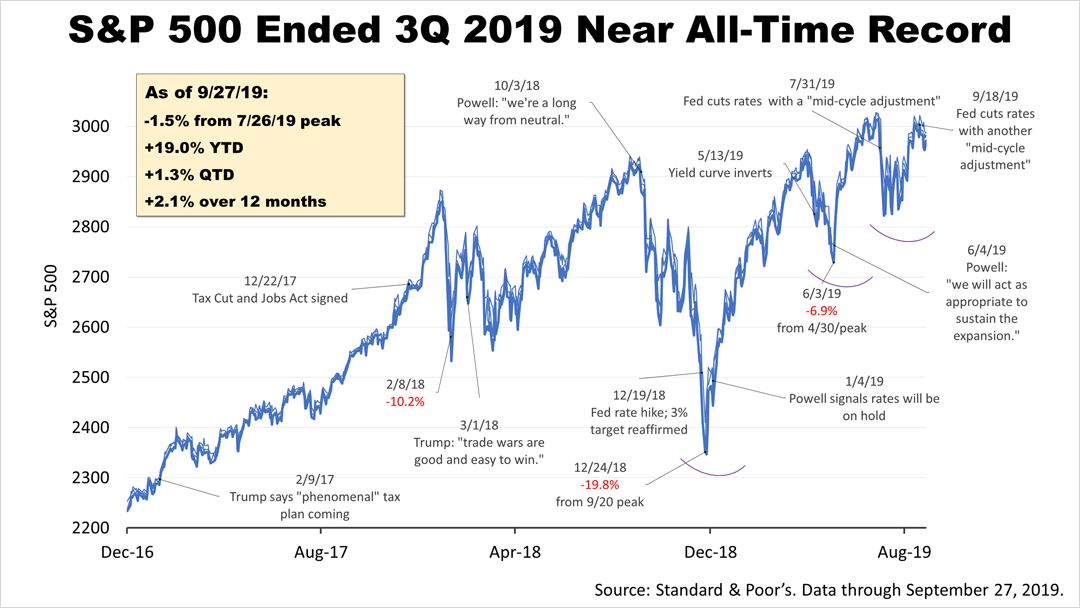

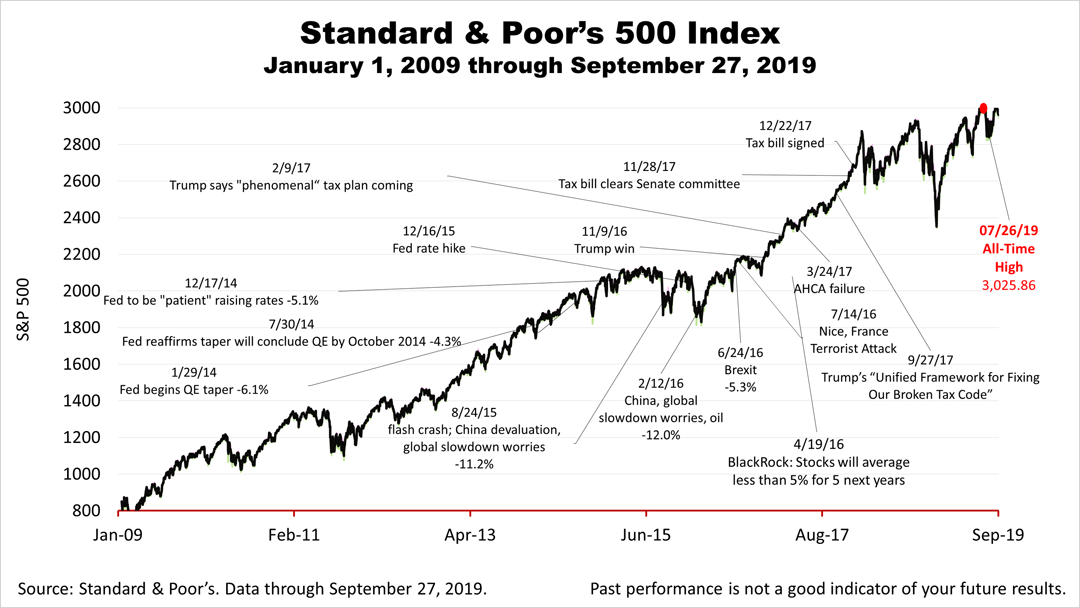

Despite frightful financial news, the third quarter of 2019 ended with American stocks just 1.5% off its all-time high on July 26th.

Over the last 12 months, which includes a -19.8% bear market loss last Christmas, the Standard & Poor's returned +2.1% in value.

Year to date, the S&P 500 returned 19%, despite rising fears over the:

- U.S. political crisis

- trade confrontation with China

- inversion of the yield curve

- growing chorus of recession predictions

No one can predict financial economic conditions, but we do know consumer income and spending are about as strong as ever in post-War American history.

Despite the increasingly grim news about financial economic conditions, the political crisis, and an expected slowdown in the rate of GDP growth for the next decade, the Standard & Poor's 500 stock index ended the quarter well.

Fairly valued relative to its long-term history, the S&P 500 closed on Friday at 2,961.79.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

© 2024 Advisor Products Inc. All Rights Reserved.

More articles

- No Recession But A Slower Pace Of Growth

- Fickle Financial Headlines Brighten

- Economy Gets Bad Press Again

- Europe's Growth Problem And Your Portfolio

- Stocks Dropped 2.6% On Friday, As Reality Gap Seemed To Widen

- A Prudent Perspective On Recent Volatility

- A Tale Of Two Economies

- Amid Worries, New Equity Risk Premium Data Explained

- GDP Rose More Than Expected; Stocks Top Record Again

- Slower Growth Confirmed By June Leading Economic Indicators

- Stocks Closed At A Record High; Should You Worry?

- Amid Record Stock Prices, Fed Policy Is A Risk

- Uncle Sam Delivers A Strong Economy

- A Dramatic Pause, As Expansion Breaks Longevity Record

- The Explosion In Real Retail Sales You Never Hear About