Find The Major Economic Trend Hidden In This Picture

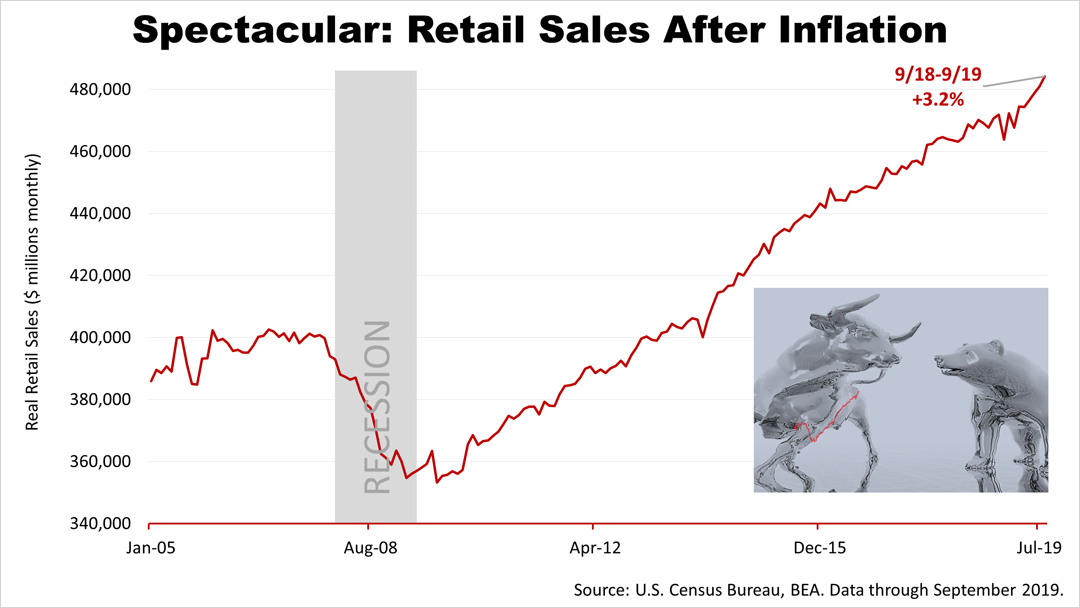

Major economic trends are always in front of us, hidden in plain sight. The spectacular real retail sales growth trend is in this picture, but you won't see it unless you know to look for it.

Real retail sales are spectacular, adjusted for inflation. Since March 2019, real retail sales shot almost straight up in a short time and were already at a record territory for several years.

Retail sales are a proxy for consumer strength and consumers drive 70% of the economy. So, this is an influential trend. However, unless you know to adjust retail sales for inflation, you would miss the trend. That's how the media reported it.

After the U.S. Commerce Department released the latest monthly retail sales figures on Friday morning, the financial press and financial cable TV channels reported that October's three-tenths of 1% uptick over September allayed fears of a downturn, but it was nothing spectacular. They missed the hidden trend in the economic picture by not adjusting retail sales for inflation.

Inflation is at a long-term low and is not showing any sign of returning anytime soon to its past performance in the 1970s, 80s and 90s. A low inflation rate masks strong real growth in consumer spending. The trend is unfolding in the current investment picture. Spotting it requires a trained eye and the media and financial press may not always recognize such hard to read changes in the economic fundamentals.

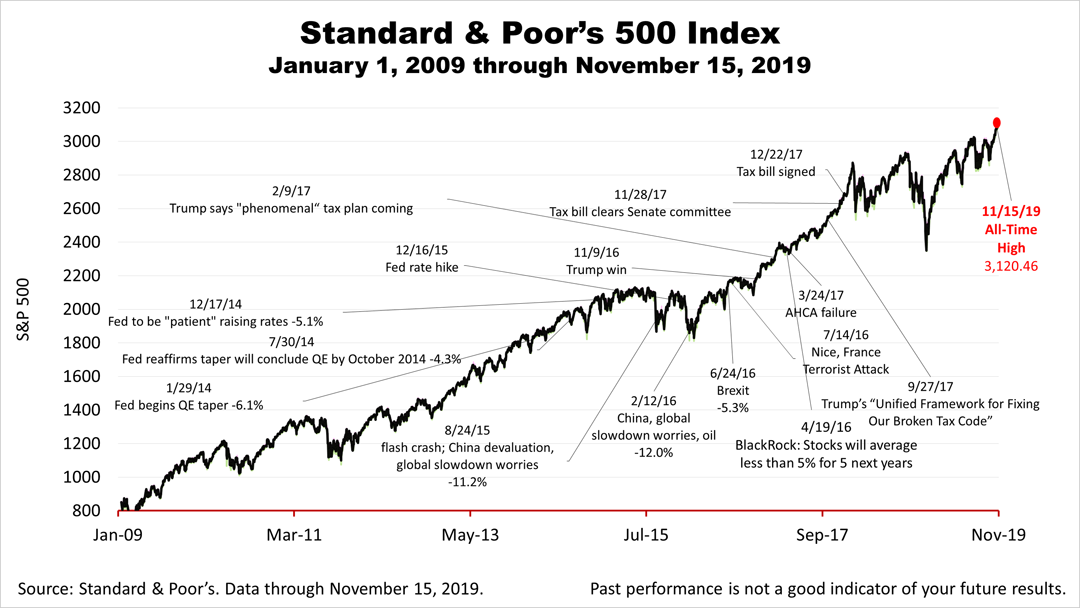

Viewed from this perspective, the newly released retail sales data helps explain why stocks broke a new record for the third consecutive week, with the S&P 500 closing on Friday at 3,120.46.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

© 2024 Advisor Products Inc. All Rights Reserved.

More articles

- Is The New Record High In Stocks Irrational?

- Stocks Break New Record; Economic Outlook Clears

- Despite Frights, Can The Expansion Continue?

- Retail Sales Coverage Reflected The Narrow View Of The Media

- Small-Business Optimism Declines But Remains High

- Analysis Of New Employment, Manufacturing & Service Economy Data

- Quarter Ends Well Despite Trade War, Inverted Yield Curve & Political Crisis

- No Recession But A Slower Pace Of Growth

- Fickle Financial Headlines Brighten

- Economy Gets Bad Press Again

- Europe's Growth Problem And Your Portfolio

- Stocks Dropped 2.6% On Friday, As Reality Gap Seemed To Widen

- A Prudent Perspective On Recent Volatility

- A Tale Of Two Economies

- Amid Worries, New Equity Risk Premium Data Explained