Retirement Income Reality Check

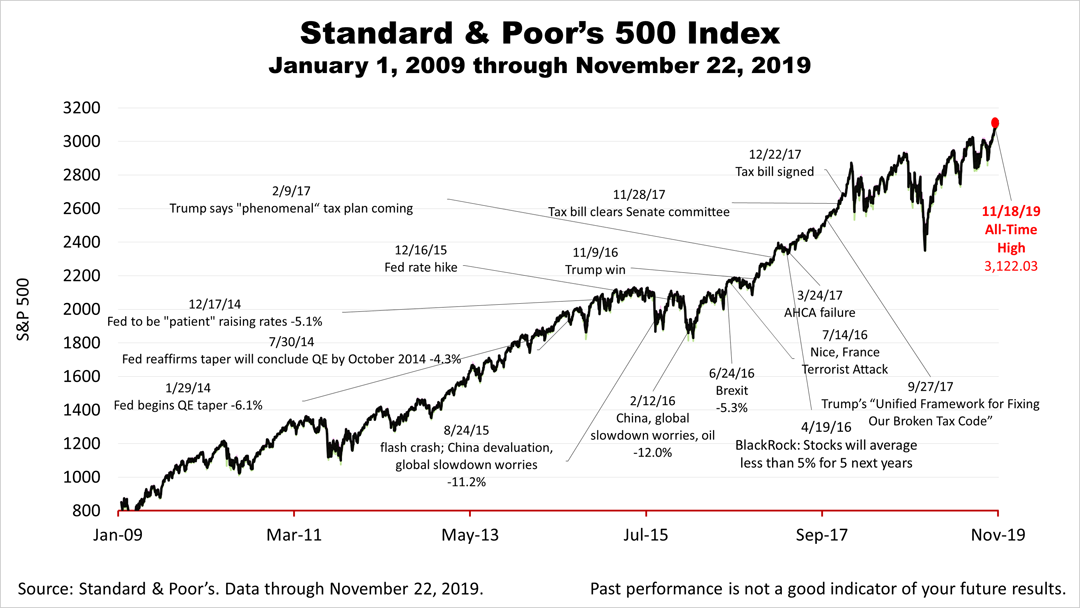

With stocks closing today near an all-time record high, a good chance of an increase in Federal tax rates in 2021, and the deadline for end-of-year tax tactics closing in, this is a reminder to run a reality check on your retirement income plan.

The $1 trillion federal deficit, the soaring U.S. debt level to pay for entitlement, and changing political fortunes make it much more likely that income taxes will head higher.

Managing your tax bracket now — with the growing likelihood of a hike in federal income tax brackets — can lower your tax bill not just this year but next year, as well. This is especially timely for business owners with an interest in a pass-through entity, like an LLC, S corp, or a sole proprietorship.

The possibility of higher tax rates, along with the stock market's recent highs, presents an opportunity for individuals with a concentrated position in a single stock. With the end of the year approaching, this is a good time to consider taking a long-term taxable gain to lower your risk of something going wrong with that company or industry.

The Standard & Poor's 500, after closing at a record high on Monday of 3,122.03, closed the week at 3,110.29.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

© 2024 Advisor Products Inc. All Rights Reserved.

More articles

- Find The Major Economic Trend Hidden In This Picture

- Is The New Record High In Stocks Irrational?

- Stocks Break New Record; Economic Outlook Clears

- Despite Frights, Can The Expansion Continue?

- Retail Sales Coverage Reflected The Narrow View Of The Media

- Small-Business Optimism Declines But Remains High

- Analysis Of New Employment, Manufacturing & Service Economy Data

- Quarter Ends Well Despite Trade War, Inverted Yield Curve & Political Crisis

- No Recession But A Slower Pace Of Growth

- Fickle Financial Headlines Brighten

- Economy Gets Bad Press Again

- Europe's Growth Problem And Your Portfolio

- Stocks Dropped 2.6% On Friday, As Reality Gap Seemed To Widen

- A Prudent Perspective On Recent Volatility

- A Tale Of Two Economies